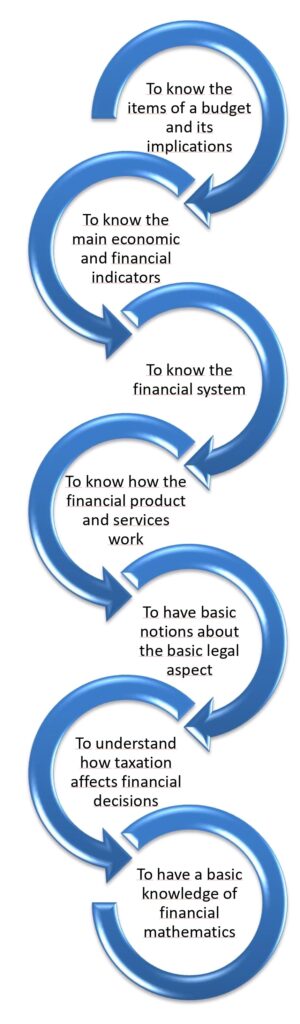

In general, a competence can be defined as a skill, aptitude or suitability to do something or to take part in a specific matter. As can be seen, the definition of competence implies being able to carry out a certain action. The following is an incomplete list of financial competences that could be a good starting point to help citizenry make financial decisions:

- To know the items that make up a budget, know how to prepare it and understand its implications for a person’s financial situation.

- To know the main economic and financial indicators, to understand how they affect the economy and the financial system and to know how to interpret the movements that occur in both of them.

- To understand the importance of the financial system for the economy, to know the functions it performs and to have a clear idea of its structure.

- To know how the financial products and services offered in the market work and what are their basic economic-financial characteristics.

- To have some basic notions about the legal aspect of financial products and services.

- To understand how taxation affects financial decision-making.

- To have a basic knowledge of financial mathematics, which allows the individual to perform skilfully basic financial operations.