When purchasing a financial product, a series of aspects must be taken into account:

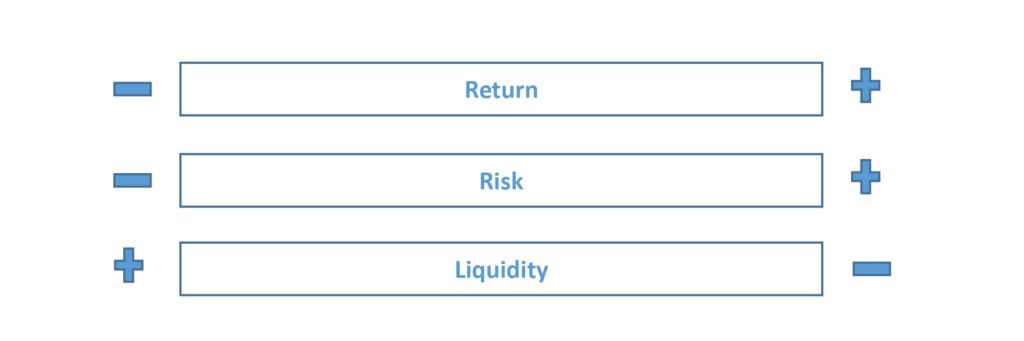

- Economic-financial characteristics. All financial instruments have basic characteristics: Return, risk and liquidity.

- Return: Indicates the yield received in comparison with the resources invested. To calculate return, two essential components must be taken into account: the monetary value secured when the invested money is recovered and the yields received throughout the life of the product. Likewise, the period of time that elapses in both cases must be considered. Finally, we must not forget that effective return is conditioned by taxation.

- Risk: Refers to different situations that may condition the value of the invested resources and that of the regular yields to be received:

- There are products (for example, deposits) in which the nominal value is not affected by any circumstance, although there will always be a certain degree of risk associated with the solvency of the institutions that receive the funds. In the case of deposits, a fund usually guarantees depositors the receipt of certain amounts. Other products (for example, stocks) are, on the contrary, subject to market valuation, so the money invested can be altered, positively or negatively.

- Apart from the previous type of risk, there is another risk associated with the perception of the regular yields expected throughout the life of the product and the specific amount to be received. In equity instruments, there are no predetermined fixed yields, unlike what happens with fixed income. However, it may occur that the yields to be received on the fixed income, even if they are pre-established in time, are not fixed but variable, if it is established that their amount depends on how an index that is adopted as a reference evolves (for example, some stock index).

- Liquidity: Refers to the possibility of reimbursing the funds invested at any moment in time without incurring significant costs.

The three basic variables mentioned, return, risk and liquidity, are not independent, but there is a relationship among them. Thus, normally a higher (achievable) return is associated with a higher degree of risk. Likewise, less liquidity is usually associated with higher yields.

- Legal framework. This aspect is fundamental, since the legal nature determines that a financial instrument can be radically different from another: For example, whoever takes out a time savings deposit knows that, at its expiration, they will recover the corresponding funds from the deposit-taking institution. On the other hand, whoever buys shares of a company, in order to recover their money, will be subject to someone wanting to acquire the shares, at the price prevailing in the market at that time. Therefore, it is essential that, before purchasing a product, its nature and function are clearly identified.

- Tax treatment. It is necessary to analyse how taxation affects each of the stages that can be distinguished in the life of a financial product:

- At the time of investment.

- When yields or changes in value arise.

- At the time of recovering the investment.

In the case of savings products, attention must be paid to the impact that investing in a specific product may have. In the event that such investment entails some type of tax benefit, the effective return of the transaction increases for the saver, which must be taken into account when calculating the return generated.

On the other hand, it is necessary to take into account the withholdings of the income tax that are applied on the regular income received and, likewise, check later if any additional amount will have to be paid.

Consideration of taxes allows the saver to get an idea of the net amounts that they will receive over time.

So, it will be possible to calculate the net return that is expected to be received from the investment considered.