Most of the economic transactions of the company imply the inflow or outflow of monetary resources, that is, in collections or payments. A good cash management should allow all payments to be made on time and unprofitable funds to be minimized. The financial system offers a wide range of products that make possible to get a return from surpluses even in the shortest periods as well as to channel the flows of collections and payments, such as the aforementioned current credit account. Likewise, the financial system enables a wide range of means of payment adjusted to the most diverse situations that may arise.

Cash management includes the decisions that must be made in a company to:

- Have the money necessary to develop business activities (payments to suppliers, staff, financial debts, taxes, etc.). This is achieved through continuous control, under a forecasting approach, of cash movements, made or future, usually combined with the use of bank financing.

- Monetize cash surpluses that are generated during normally short periods, in order to avoid idle funds. This is achieved by choosing the right financial products to get returns without sacrificing liquidity or security.

- Rationalize the financial costs of the company. It is something that can be achieved by choosing the most appropriate financing products in each circumstance, the negotiation of refinancing transactions, the change of conditions in the purchased products in order to adapt them to the market situation, or the partial repayment of loans and credits, among other possible decisions.

- Carry out an adequate management of possible currency and interest rate risks.

For the company, the treasury department or area becomes its “first bank”, to which it turns to finance its needs or invest the surpluses it generates. Such department or area is subject to be evaluated in terms of results (financial expenses it generates versus the financial income it contributes).

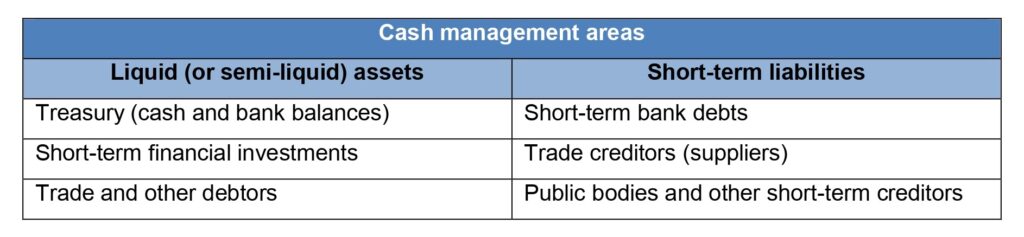

Cash management comprises the areas of the balance sheet that we know as liquid (or semi-liquid) assets and short-term liabilities.

Cash management must comprise the following functions:

- Control and realization of collection and payment flows.

- Monitoring of bank positions.

- Investment of surplus cash.

- Financing of cash requirements.

It is essential to know the dynamics of the company’s collection and payment flows and how it affects its liquidity:

- There are two classes of money flows of opposite sign: Those of collection and those of payment. Basically, they have their origin in the operating activities derived from the sale and purchase cycles.

- The flow of collections is the engine of the company’s liquidity and, in the case of an industrial company, it is usually conditioned by the following stages:

- Order: From the reception of the customer’s order until its entry in the factory.

- Manufacturing: From the reception of the order until the entry of the product in the warehouse.

- Delivery: From the entry of the product in the warehouse until its physical delivery to the customer.

- Billing: From the date of delivery of the good to the moment of issuance of the invoice.

- Expiration of the invoice: From the date of issuance of the invoice until its due date.

- Collection: From the due date of the invoice until the receipt of the funds (accounting date).

- Effective disposal at bank account: Period from the date the collection is recorded until its effective crediting in the bank account. In this regard, the relevant date is the value date, which is the date on which the bank effectively pays or charges a transaction and, therefore, is the date used for the valuation of debit or credit interests on bank accounts.