The cheque is a commercial document, accepted as a means of payment, which is issued and signed by a person (drawer) so that a financial institution (drawee) pays the amount indicated in it to another person (holder or payee), as long as it has of funds in the account against which the cheque is drawn.

The parties involved in a cheque are:

- The “drawee”: Financial institution that provides the drawer of the cheque and in which the drawer has an account with which to meet the payment of the obligations incurred by virtue of such commercial document.

- The “drawer”: Person, natural or legal, who undertakes to comply with the payment obligation contained in the cheque. It is, therefore, the debtor.

- The “payee” (also called “taker” or “holder” of the cheque): Who is in possession of the cheque and, therefore, the person to whom it corresponds to receive its amount.

Cheques must meet a series of requirements:

- The denomination of “cheque” indicated in the document itself.

- The amount of money to be paid, expressed both in figures and in words (if there is a contradiction between the amount indicated in figures and that indicated in words, the amount indicated in words will prevail; with different amounts, either in words or in figures, the lower quantity shall prevail).

- The name of the person obligated to pay, which must necessarily be a bank or deposit-taking institution in which the drawer has funds.

- The place of payment, where it is payable.

- The date and place of issuance of the cheque.

- The signature of the person issuing the cheque (drawer).

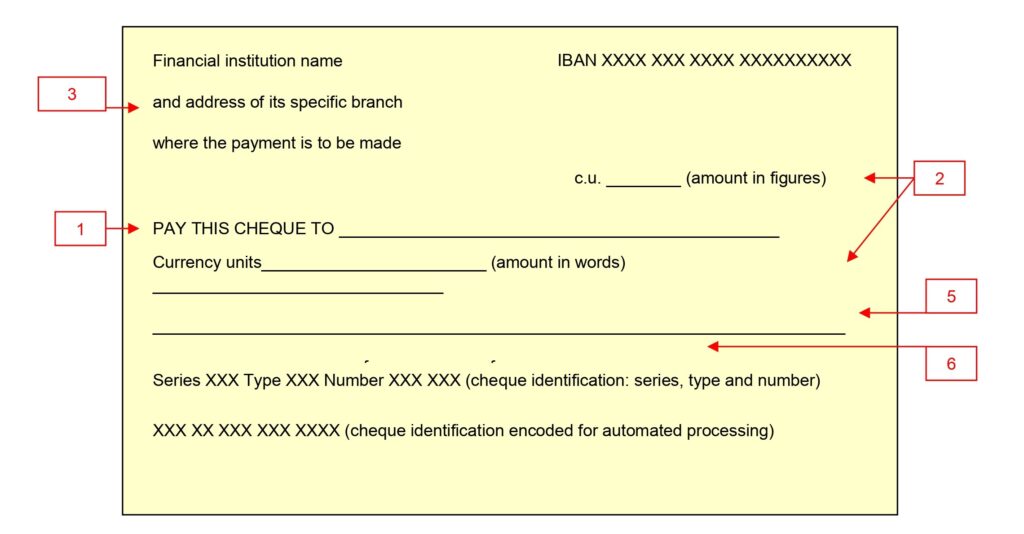

In practice, issued cheques usually have a general format similar to the following:

Any natural or legal person with the legal capacity to be bound, who has reached an agreement with a financial institution for such purposes, can issue a cheque. In this sense, the drawer will have a bank account open at the financial institution, the latter having delivered to its client the corresponding chequebook that will allow them to proceed to use them as a means of payment.

We can find several types of cheques, which we can classify as follows:

Depending on the indication or not of the payee in the document itself:

- Order cheque: Issued in favour of a specific person.

- Bearer cheque: The person empowered to cash the cheque is not specified, so that any holder of the cheque may present it for collection.

Depending on its possibility or not of endorsement:

- Cheque “to order”: The one in which it is expressly stated that it can be endorsed (transmitted) to a third party, so that the cheque will be payable to whoever appears as its legitimate holder at the time of the payment request.

- Cheque “not to order”: Cheque not transferable by endorsement, so that only the person in whose favour it was issued may request payment.

Depending on its possible guarantee:

- Unguaranteed bank cheque.

- Certified cheque: Cheque in which the financial institution guarantees, upon issuance, the authenticity of the drawer’s signature and the existence of funds in the amount indicated in the document.

This is a guarantee for the payee of the cheque, since when the cheque is drawn, the drawee makes a withholding on the drawer’s account for the amount entered in the cheque. In this way, the existence of funds available in the aforementioned account for future collection is ensured.

In practice, the certified cheque is not used, having been replaced by the banker’s cheque.

- Banker’s cheque: Cheque in which the financial institution itself not only acts as a drawee but also as a drawer (it is issued by itself), thus committing itself to the payee to pay the amount indicated in the cheque, retaining the amount thereof.

At the time of issuance of a banker’s cheque, the amount of the same is debited in the account of the ordering client.

Depending on its payment method:

- Crossed cheque: A cheque is crossed by drawing two parallel bars on the face of the cheque. This implies that the cheque can only be cashed at a financial institution (in addition, if the name of a specific financial institution has been detailed between the two bars, it can only be cashed through it). In the event that the payee is a client of the financial institution itself, it may be collected in cash. Otherwise, it will be necessary for the collection to be made by crediting the account.

- Account payee only cheque: This cheque bears the expression “account payee only”, and therefore, it can only be cashed by crediting a bank account and cannot be cashed in cash.

The transfer of a cheque is called an “endorsement” and implies the transfer of all the collection rights inherent in such document. The endorsement will be valid unless the cheque contains the clause “not to the order”, in which case it can only be transferred as an assignment of claims (that is, by transferring ownership of the claim).

The endorsement execution is simple: It is enough to indicate this instruction in the text of the cheque itself and that will be signed by the endorser (the one who transmits it). The endorsement can be made indicating who is the new legitimate holder of the cheque (endorsement in favour of a specific person) or without any indication (blank endorsement). For their part, bearer cheques can be transferred by simply handing them over to their new holder, since they do not identify the payee.

The endorsement does not admit conditions, and each endorser will be liable for the payment towards the subsequent holders of the cheque, unless the contrary is established in the cheque itself (prohibition of a new endorsement).

Payment of a cheque can be secured by guarantee, either for all or part of its amount. Such guarantee can be provided by any person or by whoever has signed the cheque, except by the drawee.

The way to guarantee a cheque would be the following:

- State the guarantee on the cheque by using the word “by guarantee” or equivalent.

- Indicate who is the guarantee (in the absence of an indication, it will be understood that it is the drawer).

The cheque is payable on demand, so it can be cashed on any date, regardless of the date on it.

However, there are maximum periods after which the drawer is empowered to revoke the payment order. That is, until the maximum legal term is reached, the holder may request the payment of the cheque, which will be credited to them as long as there are sufficient funds in the drawer’s account. Once this legal maximum period has elapsed, the cheque may only be cashed if the drawer has not revoked the payment order and, in any case, subject to the existence of funds.

Within the maximum term for the presentation of the cheque (from 15 to 60 days, generally), the drawer cannot refuse to pay the cheque if there are funds in their account, nor order their financial institution to block such payment, with some exceptions (loss or illegal deprivation of the cheque).

Neither can the financial institution (the drawee) reject the payment of the cheque if there are funds available in the drawer’s account. And this even if the existing funds do not cover the total debt, in which case the drawee must make a partial payment (which, in addition, the payee will be obliged to accept).

To be able to cash a cheque or deposit it into a bank account it is necessary to visit a financial institution. Thus, depending on the financial institution that is used, it will be necessary to distinguish:

- That the payment document be presented for collection at the same financial institution and at the same branch indicated by the drawer on the cheque: The payment of the amount will be immediate, as long as there are sufficient funds in the drawer’s account.

- That the document is presented at any other bank branch other than the one indicated by the drawer on the cheque: In practice, the financial institution where the cheque is presented for collection retains the amount of the payment of the cheque for a period of 3 business days usually in order to verify the existence of funds in the drawer’s checking account and, where balance is sufficient, at the end of such period it releases the retention. This assumption can also occur between branches belonging to the same financial institution. That is, in the event that the cheque has been issued by a branch of the financial institution A and the creditor is going to cash it from a different branch, although it belongs to the same financial institution A, the payment may be retained for a period of 3 business days to verify the existence of funds in the drawer’s account. Everything will depend on the internal regulations of the institution itself, which, as a general rule, establish certain requirements for immediate collection: Cheques below a certain amount, signature of the drawer digitized by the financial institution, etc.

If the document is presented at a bank other than the one in which the drawee is a customer, the financial institution, in practice, retains the amount of the payment of the cheque for a period of 3 business days, in order to verify the existence of funds in the checking account of the drawee and, where the balance is sufficient, after such period the retention is released.

In the above case, the intervening banking institutions act through the Electronic Clearing System. It is a series of technical and operational agreements and instructions that are not considered norms —and, therefore, are not enforceable against third parties, that is, the clients of the institutions—, but which are mandatory for the participant institutions.

In addition to the lack of balance in the checking account, the return of the cheque may occur because the instrument has been lost or revoked. In these cases, the return periods do not necessarily have to coincide with 3 business days, and may be longer.

The main costs derived from presenting a cheque for collection are the following:

- Commission for cheque cashing.

- Commission for return: Normally it is a percentage of the face value of the cheque, with a minimum amount.

- Commission for cheque processing: In the event that the cheque is presented at a bank branch other than the one indicated in the document itself, such branch will be empowered to charge for the completion of the appropriate steps in order to validate the signature of the drawer as well as the existence of funds in your account with which to satisfy the payee.