Transfer

The term “bank transfer” refers to movements of funds between accounts opened at different credit institutions or between accounts opened at the same institution, both of the same account holders and of different ones.

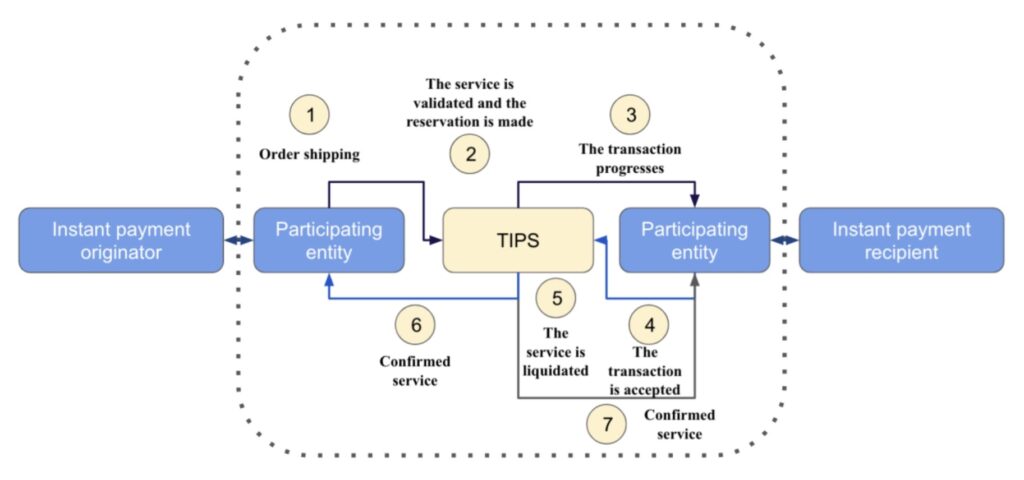

In addition, a new transfer class has emerged, the system called SCT Inst (Sepa Instant Credit Transfer), which is a payment system between the different countries that make up the Single Euro Payments Area (SEPA) and that allows transfers to be instantaneous, taking between 10 and 20 seconds to be effective. This has been achieved in part due to the elimination of intermediaries as illustrated in the following diagram:

Source: European Central Bank

These transfers cannot be revoked and can be ordered on every day of the year, but only take effect on business days. For example, if a transfer is made on Friday after cut-off time, the transfer will take effect on Monday, and if it is made on Monday after cut-off time, the transfer will take effect on Tuesday.

On the other hand, in addition to speed, the SCT Inst system of instant payments mitigates the credit risk for the parties involved due to the instantaneous availability of the funds associated with any economic transaction.

Now, the system only works for transfers of less than 15,000 euros and for transfers made between the eight countries that have so far joined this system, which are Austria, Estonia, Germany, Italy, Lithuania, the Netherlands and Spain.

SWIFT (Society Worldwide International Financial Telecommunications) is a private entity created by an international consortium of financial institutions and its mission is to ensure a swift, safe and effective transmission of documents, money and standardized messages backing operations in international financial markets.

Direct debits

Direct debit is a means of payment that consists of the permanent (but revocable) order given by a customer (debtor) to their bank, to meet from their bank account the periodic payment of some purchases made or supplies taken out to certain suppliers (originators who issue direct debit receipts).

Through direct debits, the payment of the amounts corresponding to the provision of recurring services, generally household-related, but also of business or professional origin (water services, telephone, electricity, homeowners’ association expenses, insurance payments, etc.) is met. It is also possible that the payment is direct debited for the provision of services or the acquisition of specific goods, which do not presuppose a continuing relationship (for example, the deferred payment of the purchase price of a vehicle or machinery).