Before investing in a debt product, the three most relevant factors of a financial product of this type should be analysed, which are the liquidity, risk and return of these securities:

- Liquidity tries to measure the ability of securities to offer investors an effective secondary market. In other words, it is about the ease for the investor to sell the securities on the market without entailing a high cost in terms of prices or commissions.

- The risk of the securities, for its part, will be linked mainly to the probability that the issuer can return the invested capital and meet the interests committed.

- Finally, return will be linked to the conditions of the product, among which the following stand out:

- Issuance price: The price for which the investor purchase debt securities offered by the issuer, being normally the same as the nominal value, although in some cases it may be lower or higher, depending on whether it is issued at a discount or with an issuance premium.

- Redemption value: The sum that the issuer finally pays to the investor at the time of redemption of the security. The redemption value is usually the same as the face value, but there may be exceptions.

- Redemption date: It is the maturity date of the instrument, which implies the return to the investor of the amount invested plus the last coupon or, in the case of an implicit return, the interest accumulated since its issuance. Certain products allow early redemptions (at the request of the issuer or the investor).

- Redemption premium: It is the difference between the nominal value of the securities and the redemption value.

- Coupons: They are the periodic income that the saver receives as consideration for the investment made. They are usually calculated as the product of the nominal value and the nominal interest rate. The nominal interest rate is usually fixed at issuance, but it can also be referenced to an index such as Euribor or other indices commonly used in capital markets.

On the other hand, fixed income generate returns through three different ways:

- Explicit yield: The security gives the right to receive a yield (coupon) from time to time or at maturity.

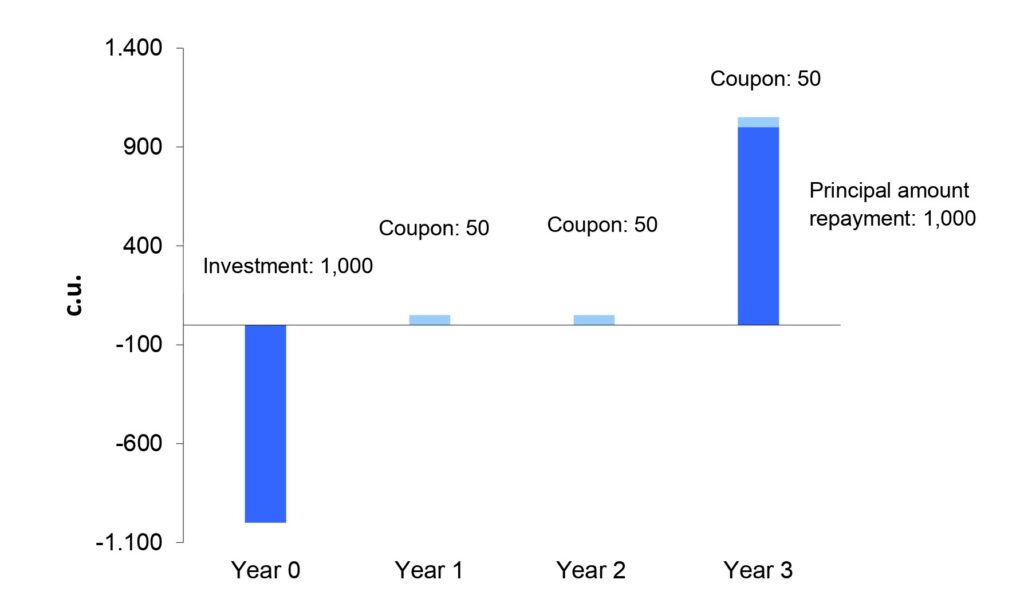

Example:A security is issued with a face value of 1,000 c.u., providing an annual interest of 5% for three years; at the end of each year, while the security is in force, the holder will receive a yield (coupon) of 50 c.u. Upon maturity, the invested capital will be returned to the investor, in this case, 1,000 c.u. That can be graphically represented by the following diagram.

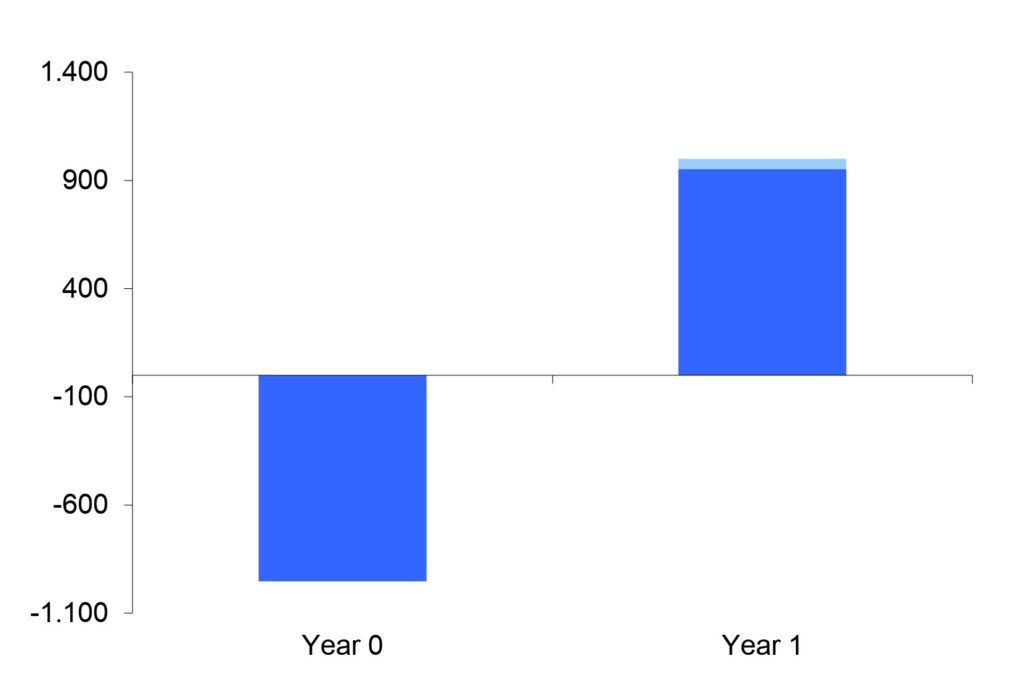

- Implicit yield: The security does not offer any explicit yield, but the interests are earned as the difference between the amount received at redemption (nominal) and the amount paid at purchase, from which the yield is discounted (securities issued with a discount).

In the specific case shown in the diagram, a security is issued with a discount for a price of 952.38 c.u. The investor pays the price and recovers the nominal value (1,000 c.u.) within one year, thus receiving the following yield: 1,000 – 952.38 = 47.62 c.u. These interests, , are equivalent to a yield rate equal to 100 x 47.62 / 952.38 = 5%.

- Mixed yield: Occurs when the two previous formulas are used together.