Demand deposits: The depositor can dispose of their funds at any time. For this reason, demand deposits are totally liquid products, with free and immediate availability. The holder of the deposit can make use of their funds through cash withdrawals, at the branch where they have the deposit, through an ATM or by cheque or transfer.

Term deposits: The deposit is made for a specified period, so the depositor cannot dispose of their funds until maturity. However, in case the depositor needs to dispose of their money in advance, they may do so, although they will have to bear a penalty (a commission or interest).

In addition, it will be important to take into account the possibility of making partial drawdowns in advance and not just total cancellations, which may entail commissions, or the accrual of debit interest for the client, which will reduce the final return.

On the other hand, the cancellation of a demand deposit is simple; the only requirement is the presence of the account holder, who must be accredited as such, indicating to the financial institution staff the desire to cancel the sight account.

Upon cancellation, the financial institution will pay, where appropriate, the pending interest, transferring it to the client or clients, after signing the corresponding document certifying the cancellation.

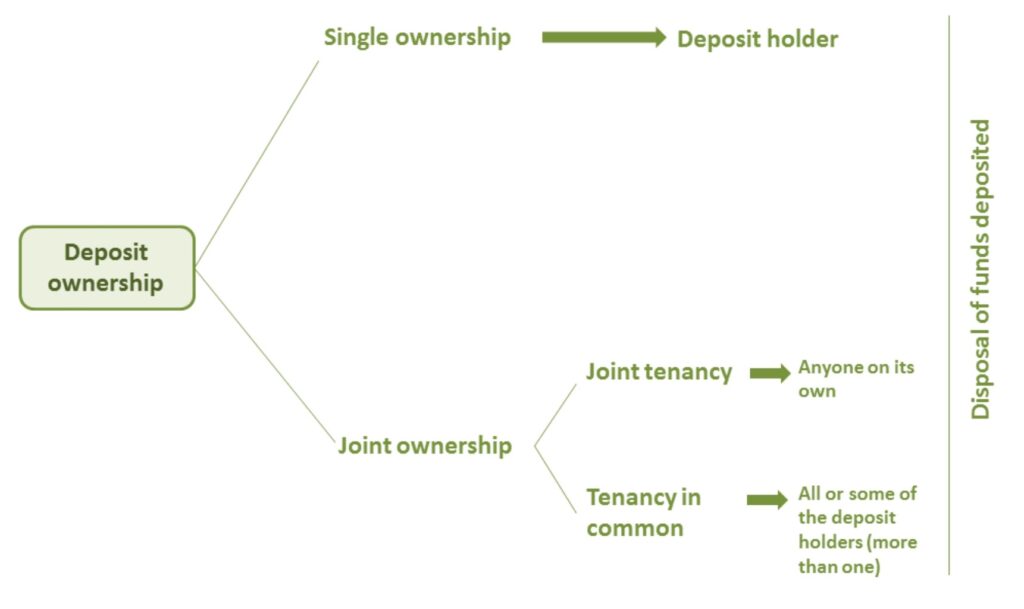

When taking out a deposit, it is also necessary to consider aspects related to ownership; as previously indicated, a bank deposit is a contract signed between the depositor and the depository. Depending on the legislation of the country, persons with the capacity to be bound or with the capacity to contract, as well as legal persons, may be holders of a deposit. The different ownership regimes are included in the following diagram.

A deposit can therefore have a single owner (single ownership) or multiple owners (joint ownership). In the case of joint ownership, it will be necessary to indicate to the financial institution the joint ownership regime that has been agreed between the multiple account holders (joint owners). If the joint ownership is a joint tenancy, every joint owner can dispose of the deposit on their own; on the contrary, if the joint ownership is a tenancy in common, it will be required, as decided by the joint owners, the signature of all or some of them to be able to dispose of the demand deposit. In the case of joint ownership, unless otherwise proven, it is understood that the deposited balance belongs to all joint owners in equal parts.

The services that include demand accounts are the following:

- Safekeeping of funds.

- Periodic statements of the checking account position and passbook entries.

- Chequebook (in the case of checking accounts).

- Disposal of funds, access to debit cards, and credit cards.

- Direct debit of payroll or pension payments and direct debit of receipts.

- Transfers.

These services can entail a series of commissions:

- Maintenance fee: Consists of a fixed annual amount (generally chargeable on a quarterly basis), the specific amount of which usually depends in practice on the type of account and the average annual balance.

- Administration commission: It is a commission that is charged for the carrying out of a series of transactions or entries.

Naturally, depositors of money in the deposit institution want to get some advantage with their deposit, which is why demand deposits are interest-bearing, although due to their immediate availability, they offer a very low interest rate. Within the types of remuneration, the following can be distinguished:

- Remuneration from the first c.u.

- Remuneration based on a determined average balance.

- Remuneration in tranches, where the applicable interest rate increases with the average balance of the account, according to different tranches or intervals.

Remuneration in kind can also be established.