Alternative means of payment: Electronic money; debit, credit and prepaid cards; electronic channels; mobile devices

Module 0

Introduction

Module 1

Family budget management

Module 2

Basics of financial decision-making: Financial instruments, characteristics, core variables and decision criteria

Module 3

Financial decision-making by entrepreneurs, businesspersons and professionals

Module 4

The psychology of financial decisions

Module 5

The interpretation of economic-financial information

Module 6

The quantification of the economic financial information

Module 7

The role and functions of the financial system

Module 8

The digital transformation process

Module 9

The legal framework

Module 10

The use of means of payment

Module 11

Deposits

Module 12

Loans and credit facilities

Module 13

Fixed income

Module 14

Equity securities

Module 15

Collective investment undertakings

Module 16

Retirement products

Module 17

Other financial products and services

Module 18

Exercises

For anyone, the act of paying is such a matter of daily life that it is hardly to pay attention to it.

The means of payment are a set of tools that serve to make the payment of economic transactions between the different economic agents, avoiding the need to use physical money (coins and bills).

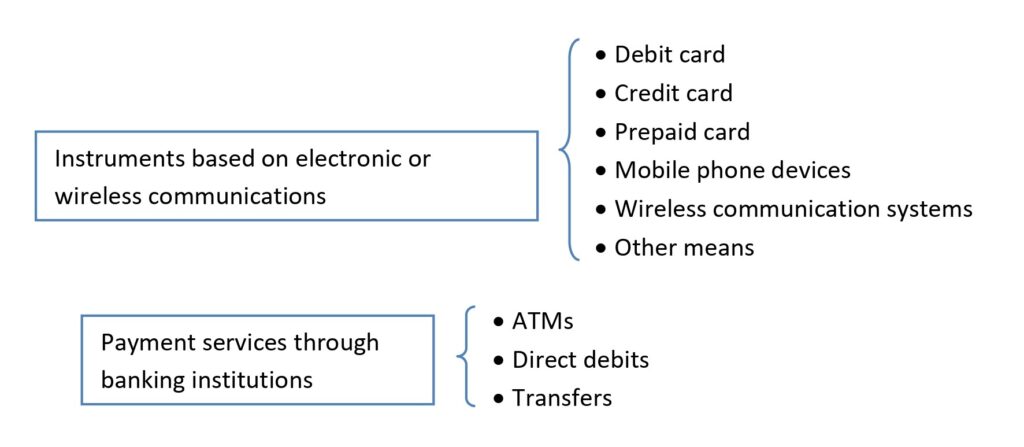

Banks have realised the power of new information and communication technologies, facilitating the implementation of new, more efficient and profitable channels, through instruments based on electronic or wireless communications, offering the opportunity to save costs, improving the operation of daily operations.

Payment services through banking institutions are another example of this type of means of payment:

On the other hand, the means of payment can also include commercial documents such as the bill of exchange, the cheque and the promissory note.

On the other hand, the means of payment can also include commercial documents such as the bill of exchange, the cheque and the promissory note.

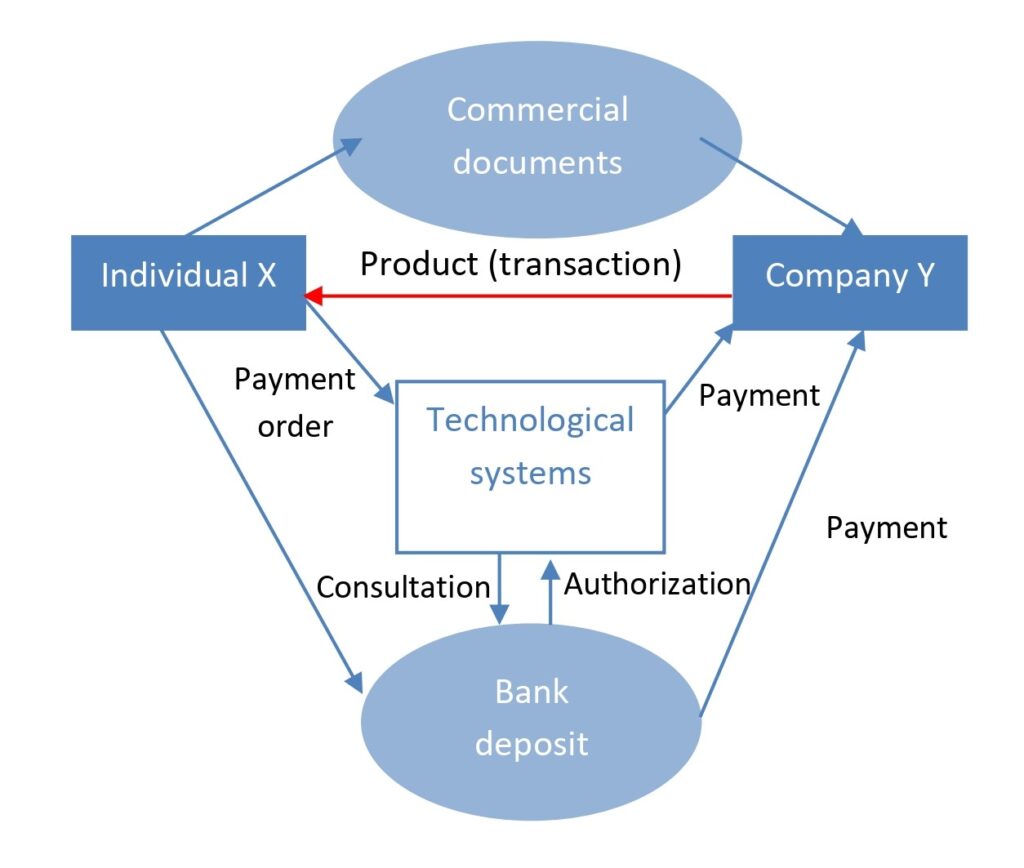

Therefore, in an economic transaction in which a company delivers a product to an individual, the individual may make the payment in various ways:

- Through a commercial document supported by the use of a bank deposit (card).

- Through a technological system, which, after receiving the payment order, checks in the individual’s deposit if the balance is sufficient, and when authorized, it will make the payment to the company, as can be seen in the diagram: