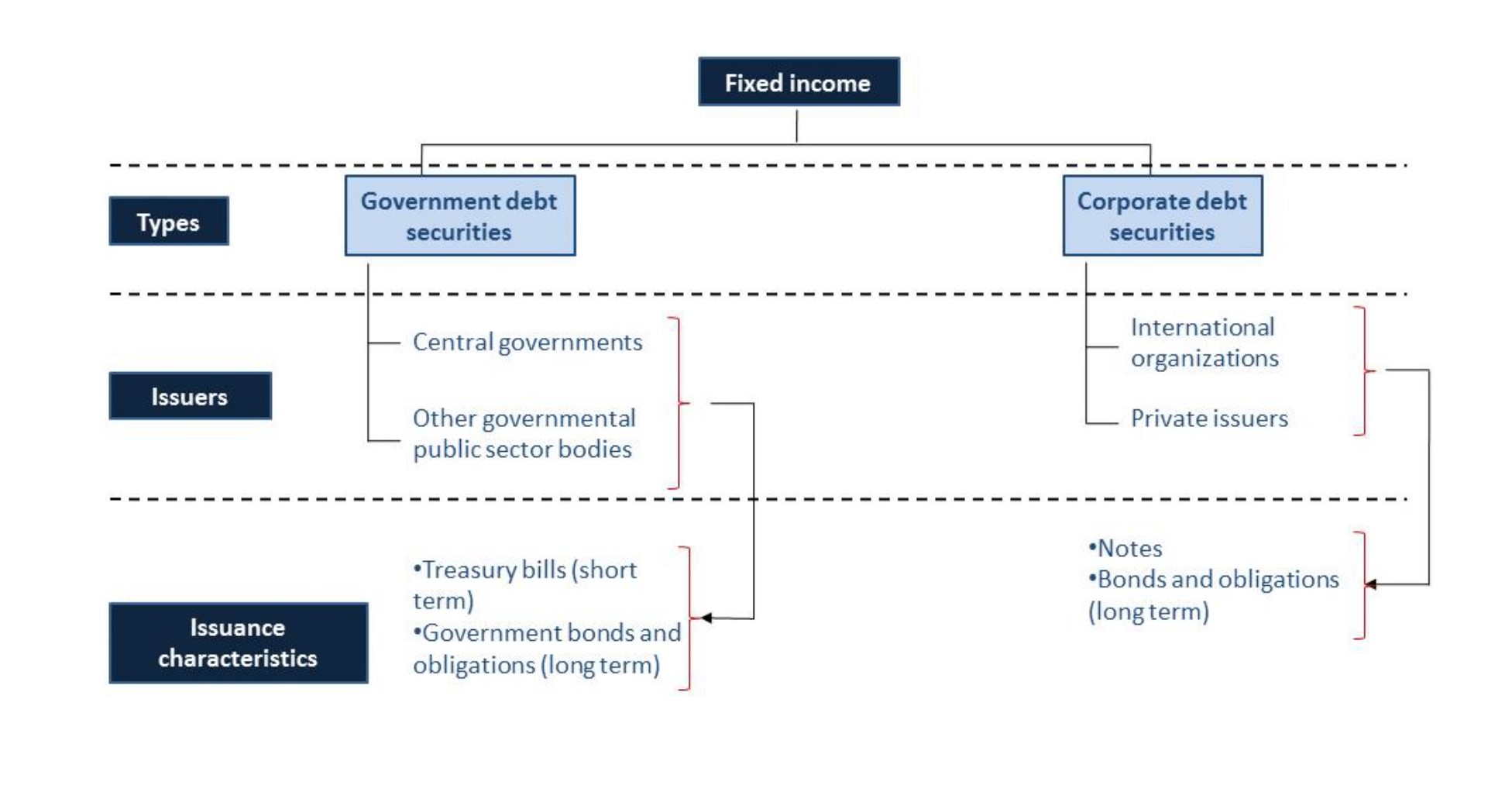

Assets known as fixed income are those negotiable securities issued by public bodies (government debt securities or gilts) and private companies (corporate debt securities or credit) for which the investor who purchases them directly grants a loan to the issuer, who is committed to return the capital at maturity and to pay the agreed return, regardless of the results made each year.

Therefore, the investor who allocates their savings to fixed income must be aware that the holding of securities of this nature only grants them rights of an economic nature, and not of a political nature, that is, they do not participate in the decision-making of the issuing company; they only have the rights derived from their status as a lender:

- The receipt of a return periodically or at once, as long as they own the security.

- The right to recover the investment made under the terms set in the issuance.

In short, the investor becomes a creditor of the government or private institution that issues the security, but not its owner, so that in the event of liquidation of the private issuer, it holds a priority position vis-à-vis the shareholders, if any.

Typically, issuers of fixed income are classified according to the following categories:

- Central governments.

- Other public sector bodies: Government agencies, regional governments.

- International organizations (e.g.: World Bank).

- Private issuers: Private companies.