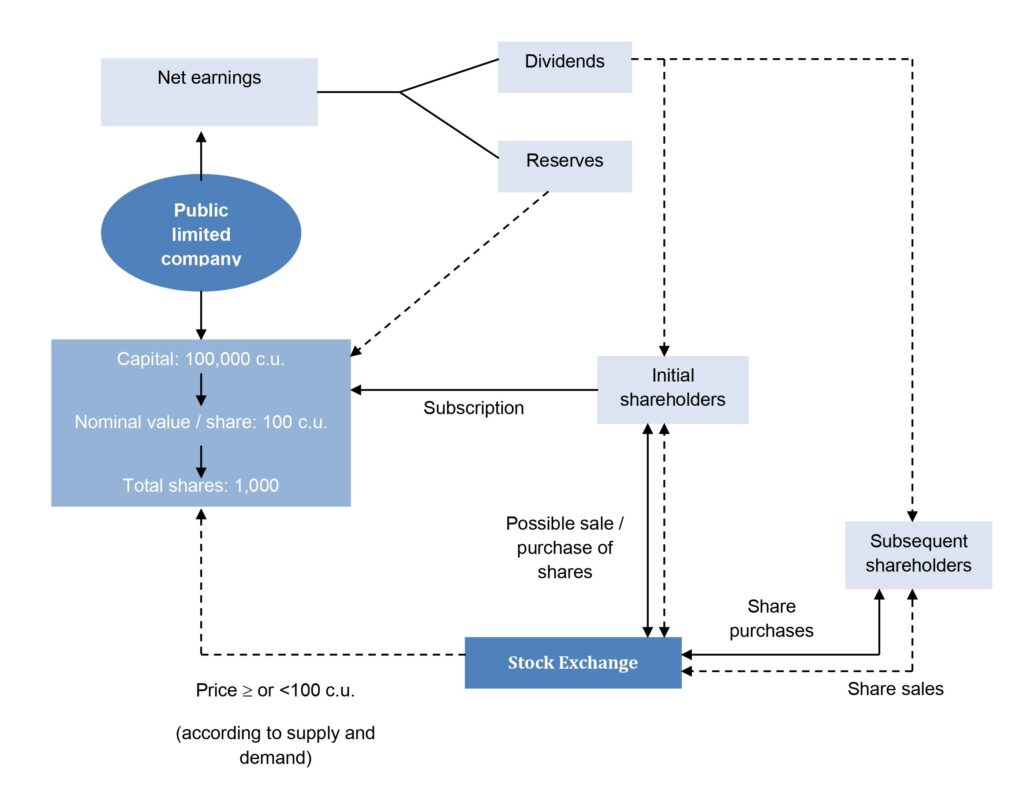

Unlike fixed income, equity securities represent the raising of own funds by a company, that is, whoever purchases them becomes one of the owners of the company and agrees to link the amount invested to the economic performance of the company, taking the risk that they may lose it completely in case of negative results. Therefore, it does not guarantee either the recovery of capital or the receipt of yields. Among these assets, it is worth highlighting the role of shares.

Shares are securities that represent equal parts into which the capital of a company is divided and are representative of its ownership. That is, they are the equal parts in which the company’s capital stock is divided:

As an owner, the shareholder will get the economic and political rights granted by such status, fundamentally the following:

- To take part in the distribution of corporate profits and in the net equity resulting from the liquidation of the company.

- Pre-emptive right in the issuance of new shares or convertible bonds.

- To attend and vote in the general meetings and to challenge the corporate resolutions. In the case of companies listed on the Stock Market, their bylaws may establish as a requirement to exercise this right to have a minimum number of shares.

- To be able to transfer their shares.

- To be informed.

The remuneration of the securities is variable, since there is no pre-established yield, but it will depend on the results that the company achieves each year and on the decision of the owners to distribute a greater or lesser dividend among shareholders. However, we must not lose sight of the fact that undistributed profits imply an increase in value for the company and, therefore, for shares.

The main ways of achieving yields through shares are the following:

- Income from the mere fact of being the owner of the shares: Distribution of profits or dividends, in cash or in company shares, sale of pre-emptive rights in capital increases or receipt of fully or partially bonus shares, capital reduction with contributions reimbursement, shareholders’ meetings attendance premiums, and others.

- Income from the sale or transfer of shares. If the transfer price exceeds the acquisition price, you will earn a capital gain and, therefore,subject to a tax capital gain. On the contrary, if the sale price were below the purchase price, you would experience a capital loss.

In this sense, it should be borne in mind that the shares do not expire, so in order to recover the amount invested (with losses or gains), a buyer must be found in the market.

On the other hand, the price of the shares is exposed to a high risk of increase or decrease, since, regardless of the evolution of the companies themselves, they are securities that are traded in financial markets where there are a large number of investors with different expectations.

The equity market is constituted by the Stock Exchanges and could be considered as a meeting point between savers and companies, where savers finance companies by buying their shares in such market, becoming shareholders.

The stock market works like any market, where the law of supply and demand always prevails depending on the different expectations of investors.

If there is a lot of demand for a certain share, it means that many investors want to buy it, so its price will rise, while if there are many who want to sell this share, its value will decrease until the supply of shares finds an equilibrium price with the demand for such shares.

In general, the situation of a market can be evaluated through stock indices. A stock index is an index number, expressed with respect to a value that is taken as a reference base, which tries to reflect the variations in the average value of the shares that make it up, in such a way that its evolution is representative of the movement of the stock market. The securities that make up the indices are the most representative of a certain market or of a specific sector, which implies that they must be periodically reviewed, depending on their market capitalization and their trading volumes and frequency.

To build an index, firstly, you have to choose, among all the securities listed on a market, those that are going to make up the index, so that the chosen sample is as representative as possible of the market.

Secondly, once the securities are selected, it is necessary to decide the criteria that will make one security has a greater importance (weight) than another does in the index. These are the most common criteria: Market capitalization, trading volumes and trading frequency.

Once the selection has been made and the weights of each of the securities have been calculated, an index calculation formula is applied.