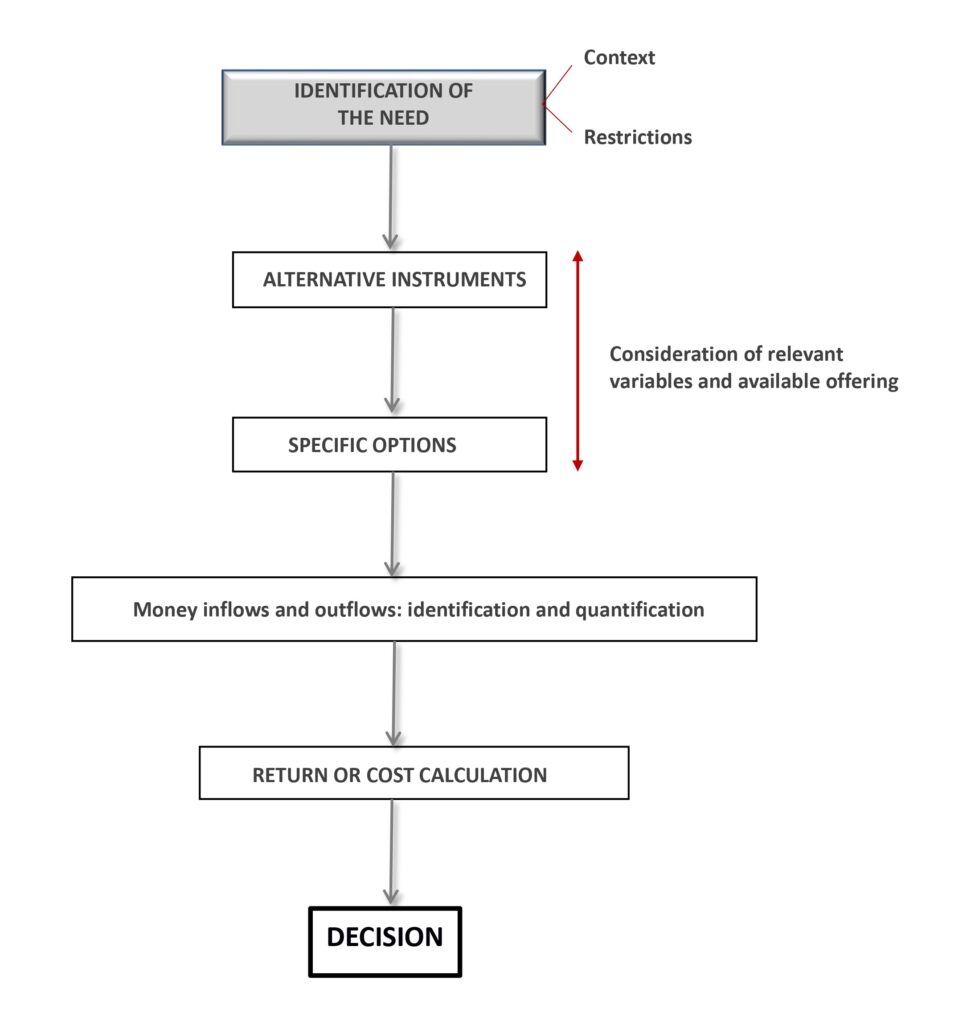

A person who has this global process in mind will be in a better position to study the specific products and services that they can take out and to choose the one that best suits their needs:

- As a starting point, it is suitable to know how to distinguish the different types of needs that a person may have in the financial field.

- The next step is to identify which institutions can meet the different needs.

- Next, the choice of a specific product can be addressed, distinguishing whether it is a transaction with or without a time dimension, that is, whether or not prolonged in time.

- The choice of a savings product presents a series of peculiarities that should be taken into account, and the same happens when it comes to choosing a credit transaction, since it is necessary to analyse the economic-financial variables that shape the financial product. However, it must also be taken into account that there is a variable that affects every product (although not in the same way) which is taxation.

Financial institutions offer a vast catalogue of instruments to choose from, without forgetting that they are designed to address different situations. Before arranging a financial transaction, the user must make sure that it is the one that best suits their needs (savings, credit, risk situations coverage, etc.).

The choice of a specific product must be based on a global appreciation of all its implications throughout the life of the product, within which three basic stages can be distinguished:

- Purchase and formalization.

- Realization of financial flows (money inflows or outflows) expected over time.

- Completion and settlement.