When preparing a budget, it is also important to take into account the evolution of the main indicators of the economic environment that families will have to consider due to the potential impact they may have on budgets:

- Evolution of GDP (Gross Domestic Product): If GDP grows, it is expected that economic activity, employment or income will also improve.

- Inflation: Price increases will have a negative impact on the family expenses.

- Exchange rate: It will determine the price of the imported products that are acquired. If the local currency depreciates, imports become more expensive. If these imported products have a significant weight in family expenses, it will mean an increase in them, generating a deterioration in the family budget balance.

- Interest rate: It has a relevant impact on financial savings and credit products. If it goes up (down), savings products will tend to generate a higher (lower) yield, while credit products will also cost more (less).

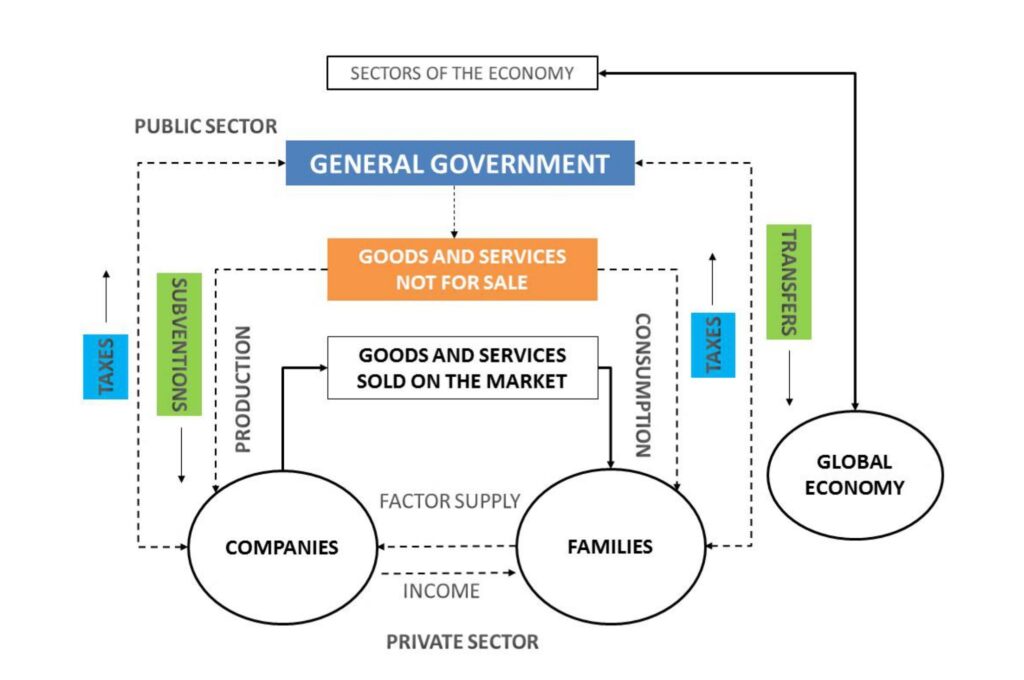

The situation of personal finances will be determined by the family’s economic position, which will be influenced by the economic environment and public policies in the area of taxes and public spending.

The public sector has an important influence on the lives of families, in some cases impacting directly on the family budget. For example, through taxes, which are used to finance general public spending programs.

On the other hand, the public sector, depending on certain conditions and circumstances, grants some social benefits to families to face situations of need or to meet other social objectives.

Finally, the public sector provides a wide range of services, in some cases free of charge and, in other cases, subject to the payment of fees, that cover basic needs of families (education, health, social assistance, etc.), although they are not explicitly reflected in the family budget.

As a conclusion, before creating a budget, the net worth has to be considered: the assets make it possible to get additional income or they can be sold to get resources, while liabilities limit the power to incur additional debt and imply disbursements of capital and interest.