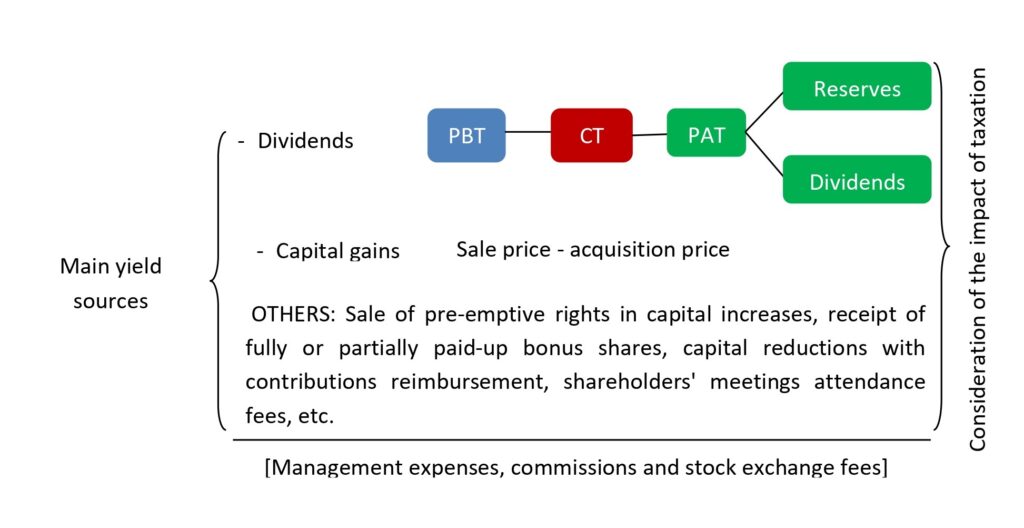

As has been shown along this chapter, the variable yield of shares occurs in different ways, in which the impact of taxation must be taken into account:

1. Via collection of dividends, which are the part of the profit of the companies that is distributed among their shareholders as remuneration of the invested capital. The shareholder can receive the dividend in cash or in shares of the company. On the other hand, one must not lose sight of the fact that the undistributed profit portion implies an increase in value, which can be received when the shares are sold.

For the effective receipt of dividends, it will be necessary:

- In the first place, logically, that the company generates profits in the accounting year.

- Secondly, that the legal and statutory requirements are met to be able to distribute dividends (have the minimum levels of reserves covered).

- Thirdly, that the owners of the company decide to distribute dividends instead of making additional allocations to the reserves.

2. Via capital gains, which are derived from the difference between the acquisition price and the sale price of the shares.

3. Via sale of pre-emptive rights in capital increases or receipt of fully or partially paid-up bonus shares, capital reduction with contributions reimbursement, shareholders’ meetings attendance fees, etc.

The three ways in which a yield on shares can be received are represented in the following diagram:

Where:

PBT: Profit before taxes.

CT: Corporation tax.

PAT: Profit after taxes.

On the other hand, it should be borne in mind that the orders sent by investors can generate different commissions and expenses, among which the following stand out:

- Processing fee: The one established by the financial institution that processes the order and to which the investor goes to process it.

- Execution commission: It is derived from the fulfilment, by the market member, of the purchase or sale order that has been transmitted to them by the financial institution (it will only be given in the event that the financial institution that received the investor’s order is not a member of the market and, therefore, must request the intermediation of an institution that does).

- Stock exchange fees: They consist of a percentage and a fixed fee, of a small amount, that the Stock Exchanges receive for the transactions they carry out. There are two types of fees: The trading fee and the settlement fee.

Additionally, the investor must know that there will be commissions for administration or safekeeping of securities, which will be charged by the financial institution where the securities account is opened, in addition to other additional expenses for specific transactions, such as the collection of dividends, the subscription of new securities, taxes on financial transactions, etc.