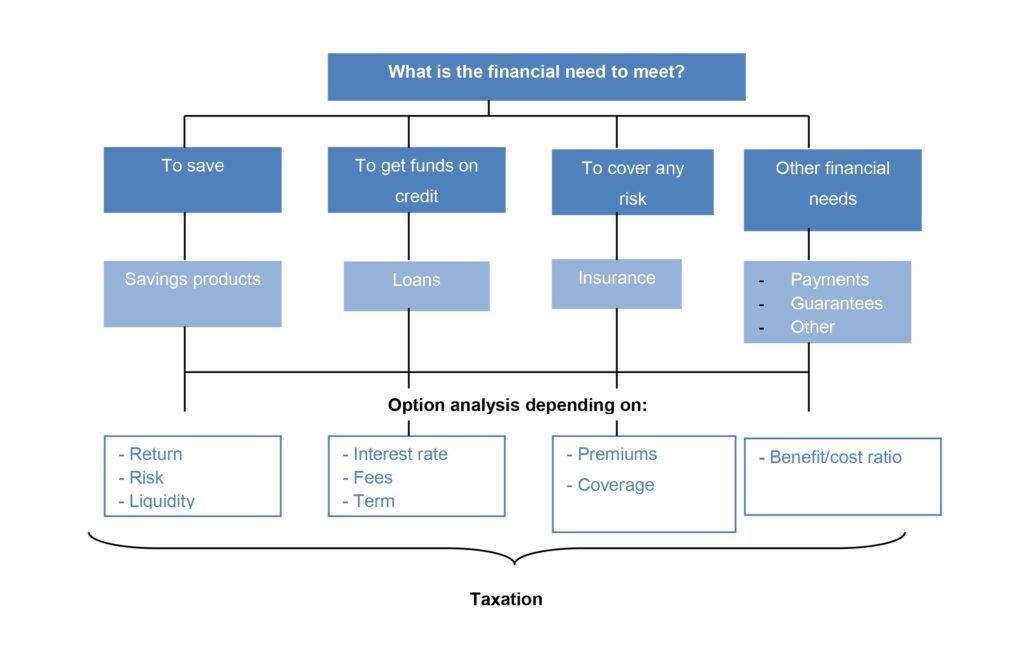

A concrete need of a client or potential user is the origin of any financial product. Otherwise the design and the selling of it will not have a meaning.

In consequence, before analysing the different phases in the financial product life, it is important to know, as much as possible, the concrete need of the person who is being considered.

Once the general framework has been defined, the crucial question of choosing a specific product that meets our needs arises.

The approach is different, obviously, if it is a service provided only once or a service or transaction that has a temporal dimension:

- If we intend to carry out a sporadic or occasional transaction, without any financial implications in the future, for example, carrying out a transfer of funds to another person, we must pay attention essentially, in addition to security, to the cost and execution time of the transaction. Every institution must have available to the public a brochure containing information on the rates and main conditions applicable to the different transactions offered.

- The aspects to be considered are broader in case of a transaction that entails future obligations for the involved parties, that is, the client and the financial institution. Suppose, initially, that our needs can be summarized in two: On the one hand, choosing a financial instrument in which to place our savings and, on the other hand, getting a loan to be able to carry out a spending project. In both cases, it is essential that we choose the option that, within our means, best suits our needs, preferences and personal circumstances. This leads us to consider carefully the characteristics of the products.

Life cycle of a financial savings product

Even when generically speaking of “financial products”, it must be borne in mind that financial institutions are companies that provide services.

The life of some of the services provided ends at the same moment in which the provision takes place (for example, when a payment order is made); in other cases, the provision is extended over time (for example, in the case of deposit safekeeping).