The legal system has established, over time, the framework in which companies have to carry out their commercial deals, defining and qualifying the rights and obligations that derive from the adoption of the different formulas that can be adopted.

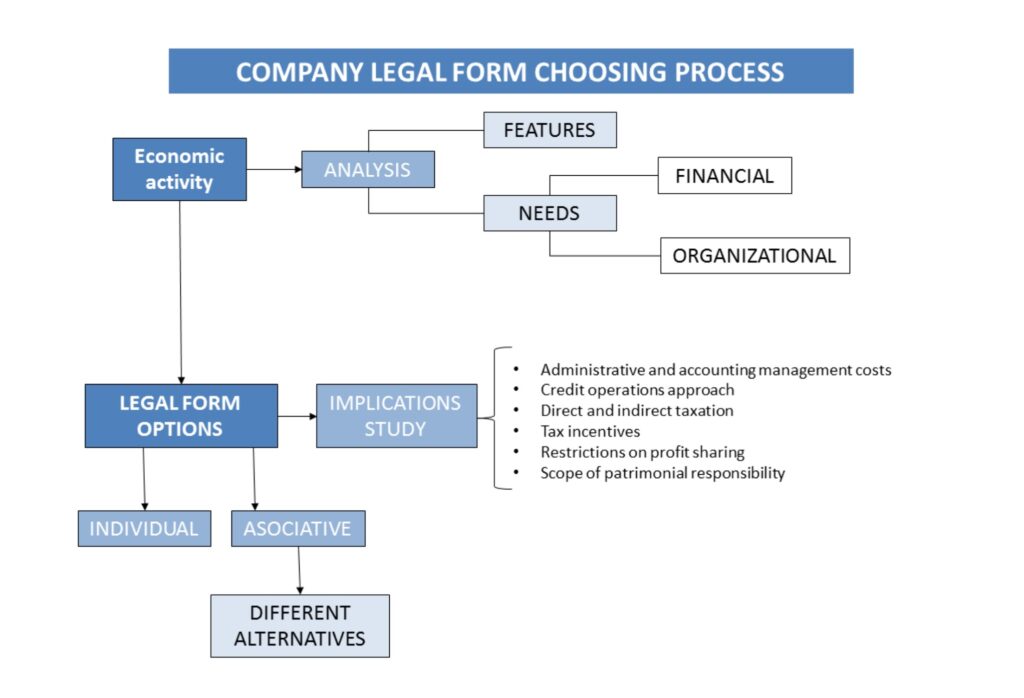

The legal form chosen can play a determining role in the costs of administrative and accounting management, in the proposal of credit transactions to financial institutions, in the degree of direct and indirect taxes faced, in the class and amount of tax incentives, in the restrictions on the distribution of profits, in the scope of the responsibility towards third parties, in the managerial organization chart, etc.

In any case, the choice of one or other legal form depends on a set of considerations —such as those mentioned—, subject to a rigorous study in the context of the creation and start-up process of each particular company.

There is more to delve into than simply contrasting the individual or the associative forms. Within this last formula, there is a wide range of choices that, although well established, are in the process of constant review, in order to adapt them to successive changes in the economic and legal environment.